“It’s bizarre, but the only free-market government in the world is in Argentina,” said Stanley Druckenmiller, one of the most admired investors in history and former manager of George Soros’ main fund.

In an interview with CNBC, Druckenmiller said that he has been investing in shares of Argentine companies – and so far he has nothing to complain about.

The investor said he was not at Davos in January, but after watching Javier Milei’s pro-market speech he immediately decided to invest in Argentina. He asked Perplexity, an AI tool, what the five most liquid ADRs in the country were and put money into them.

“I followed the old Soros rule of ‘invest, then investigate.’ I bought it, did some research work, and increased my holdings,” Druckenmiller told CNBC.

“For now it’s been great, but we’ll see,” he said. “I don’t know how long the population will give this guy, but for now his popularity has remained stable.”

The founder of the Duquesne Family Office did not give details about his positions, but some of the most traded securities in Argentina – whether shares or ADRs – are YPF, Grupo Supervielle, Lithium Americas, Arcos Dorados and Mercado Libre, in addition to the banks BBVA Argentina, Grupo Financiero Galicia and Macro. These three financial institutions lead the year’s rise, with appreciation of more than 100%.

In the last six months, the ETF Global X MSCI Argentina has increased by more than 50%.

Druckenmiller said he was surprised that Milei’s popularity had not fallen despite the economic recession and the reduction, in real terms, of social security benefits.

The Argentine fiscal surplus is largely due to the government’s decision not to replace inflationary pension losses – which represented a reduction of around 35% in these expenses.

“Javier Milei will be an interesting experiment,” commented the manager. “A very intelligent leader, trained in the Austrian School of economics. In addition to knowing economics, he is a show man.”

Milei also gained the benefit of the doubt from Ian Bremmer, the CEO of consultancy Eurasia.

In a comment posted on social media, the consultant acknowledged that he was wrong in predicting an economic collapse in Argentina with Milei’s election.

Bremmer said the country is back in fiscal surplus after a decade, and inflation is falling.

“I’m glad I got it wrong,” he said.

According to the analyst, Milei’s economic team was well received by the IMF and, at meetings in Washington, the Argentine president showed a willingness to listen to the recommendations.

According to Bremmer, Argentina will continue to face increasing poverty and a drop in living standards. The question, therefore, will be to observe to what extent government approval will remain at relatively high levels for the country’s recent history.

“But this guy deserves respect for what he has achieved so far,” concluded Bremmer.

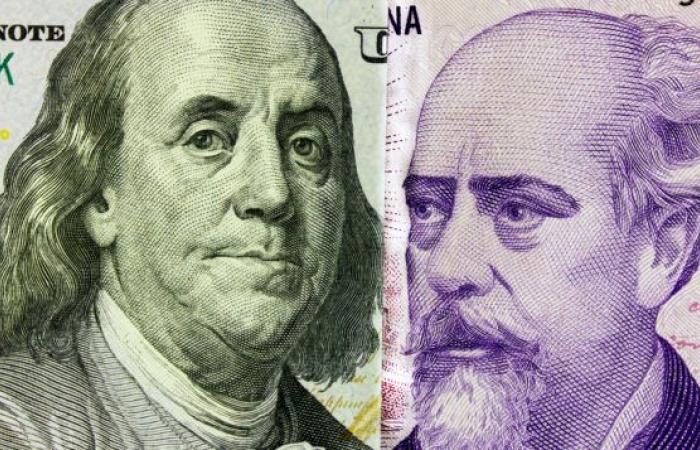

In 2023, Argentine inflation was 233%, the highest rate since the hyperinflation of 1990. The readjustments are losing strength. The April number will be released tomorrow, and there is an expectation that the monthly variation will fall below double digits.

Giuliano Guandalini

Tags: Milei promarket showman Druckenmiller buy Argentine ADRs

--