“One of the most obvious things is that iron ore will fall”. That was a speech from Luis Stuhlbergermanager of Verde Asset, during his participation in the Macro Summit Brasil 2024, an event promoted by Market Makers to discuss the macroeconomic scenario.

The rationale behind this thesis is that today Chinawhich is the largest iron ore importing country in the worldis in the middle of a discussion of inflection for good or evil and that, regardless of the scenario that comes to fruition, the price of the commodity is unlikely to remain at current levels, which currently hover around US$110.

This is because there is a structural change in China’s economy happening now. Previously, the country was focused on investments in infrastructure, especially in the field of construction, which represents 25% to 30% of Chinese GDP. It is for this reason that the demand for iron orethe raw material for steelremained high.

Now, the government’s focus Xi Jinping is to stimulate the consumption. However, two scenarios can materialize in the face of this change, according to the manager:

- China’s plan could go wrong when trying to rebalance the GDP “domestic pie” and the country goes through a “crash”, reducing demand for iron ore;

- China’s plan could work and, thus, consumption increases, also increasing the participation of this sector in the country’s GDP and drastically changing the demand for iron ore.

Note that, in both scenarios, there is a expectation of fall by the demand for iron ore, which directly affects its priceby the manager.

But why am I telling you all this? Good, because the dynamics of the Chinese economy can directly impact a large Brazilian company: Vale (VALUE3).

The mining company is a long-term partner of China and one of the first companies in the world to export iron ore to the country. To give you an idea of its relevance, today China corresponds to 60% of sales from the company.

Given the above scenario, it is natural for investors to wonder what to do with the VALE3 share. Is it time to sell? Or to buy and take advantage of the moment of entry, given that the share has already fallen -14.8% this year?

Stay with me until the end of this report to check out the answer.

Is the iron ore scenario really so catastrophic for Vale? Experts disagree

Although Daniel Goldberg/Luis Stuhlberger believe that, in the long term, iron ore will decline, this opinion is not a consensus in the marketwhich is currently divided on the topic.

Matheus Soaresan analyst at Market Makers, for example, does not see the structural change in the Chinese economy as a problem for iron ore prices.

“Despite China’s relevance to the sector, China is not the only country that demands iron ore in the world. The second country that produces the most steel is India and this number has been growing year after year,” he said in his recent column for Money Times.

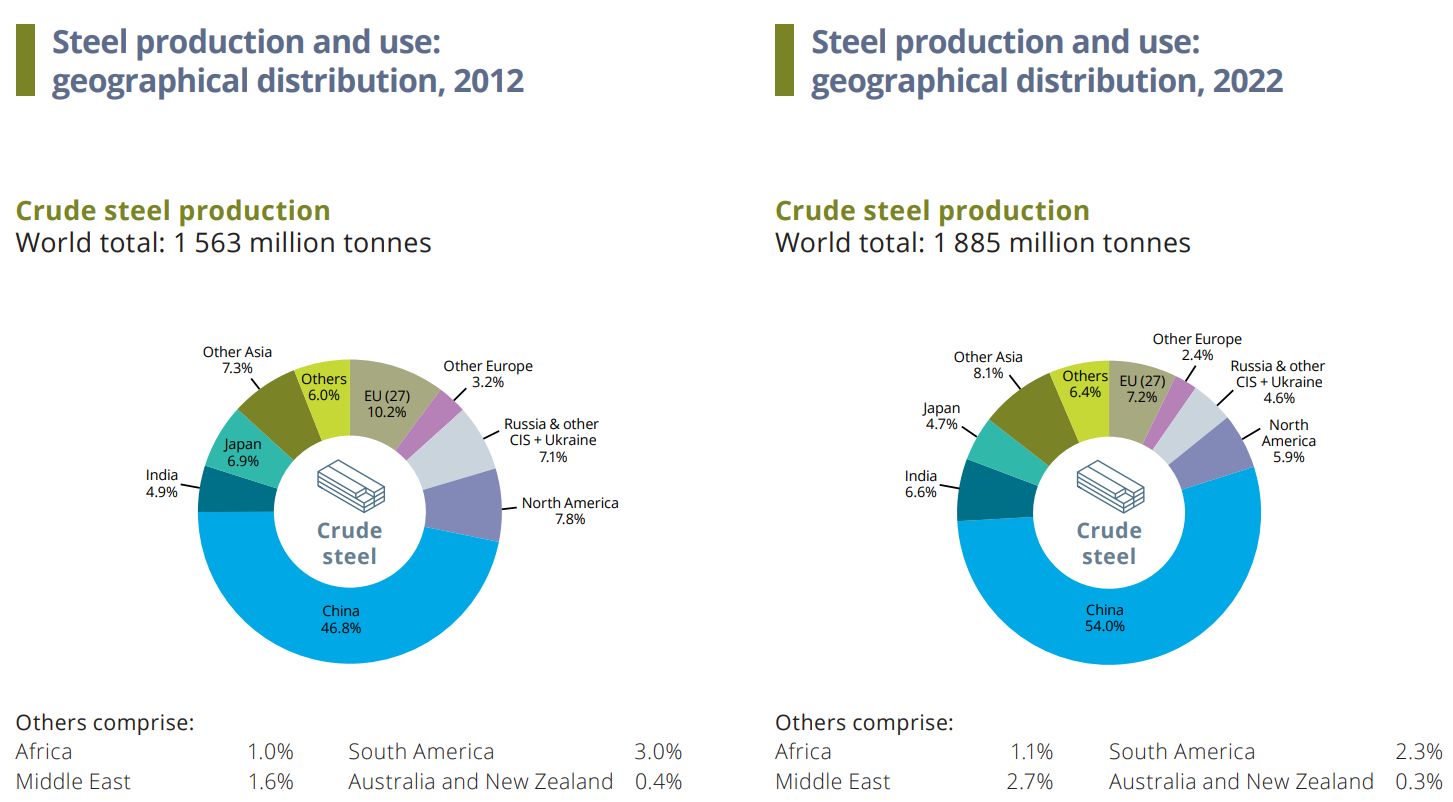

In this 2022 graph from the Worldsteel Association, for example, you can see how the India and other Asian countries, such as Indonesia It is Vietnamhave gained relevance in the sector:

Steel consumption in India increased by 70% in the last 10 years. In 2023, the country grew its consumption by 9%, became a net importer of steel and even surpassed China in number of inhabitants. Therefore, some experts even believe in the possibility of India taking China’s place as the engine of global growth.

According to Wood Mackenzie, a consultancy specializing in the sector, the increase in ore consumption in the rest of the world could compensate for the drop in Chinese consumption. This already assumes a drop of 150 million tons in demand for ore by 2030.

“I don’t disagree with those who say that China is undergoing changes to its economic pillars, but I don’t see any indication of a catastrophe for iron ore prices, at least not with the data we have available today.”

For all this, Matheus Soares highlights that Market Makers continues to be purchased from OK and believes he is being well paid for it.

As I said, the market is divided regarding China, iron ore and the Valley. That’s why I would like to invite you, investors, interested in better understanding the topic.

Next Thursday (25), the Market Turna daily program that comments on the hottest topics on the market, will feature a special edition about Vale.

The program will receive two analysts specialized in Vale to comment on the company’s results for the 1st quarter of 2024, which will be released today (23). In addition to other relevant topics, such as the price of iron ore and the Chinese economy, to then answer the question: buy or sell VALE3?

Matheus Soares, from Market Makers, is one of the guests to comment on the company’s results and his recommendation for action.

Giro do Mercado responds: time to buy or sell Vale (VALE3)?

The Giro do Mercado program is promoted by the news portal Money Times and can be accessed completely free of charge by anyone interested.

It is presented by journalist Paula Comassetto, who will welcome two analysts to comment on Vale next Thursday (25). Are they:

- Matheus Soaresanalyst at Market Makers;

- Henry Cavalcanteanalyst at Empiricus Research.

Therefore, to confirm your participation in the program, simply click the button below and register for free. You will receive a confirmation email and will be notified when the program starts live.

Participating in the program makes sense for you if you care about your assets and want to be well informed about the companies you invest in or want to invest in.

Graduated in Journalism from the University of São Paulo (ECA-USP). She previously worked at a digital marketing agency, where she worked on SEO and content marketing strategies.

Graduated in Journalism from the University of São Paulo (ECA-USP). She previously worked at a digital marketing agency, where she worked on SEO and content marketing strategies.