So far, 4 ministers have followed the vote of the rapporteur, Cristiano Zanin, for the re-encumbrance of the payroll of 17 sectors of the economy

The minister of the STF (Supreme Federal Court) Luiz Fux asked for a review (more time for evaluation) this Friday (April 26, 2024) and paused the analysis of the injunction granted by Cristiano Zanin that suspended the effectiveness of sections of law 14,784 of 2023 The decision extended the payroll tax exemption for 17 sectors of the economy until 2027.

Earlier, minister Edson Fachin had cast his vote in the virtual plenary to maintain the suspension. Fux’s vote could form a majority or open divergence. Now, the minister has up to 90 days to present his vote.

For now there are 5 votes favorable to maintaining the decision:

- Cristiano Zanin;

- Flavio Dino;

- Gilmar Mendes;

- Roberto Barroso;

- Edson Fachin.

Zanin’s decision is now valid. If endorsed by the other ministers, it will be in effect until the STF judges the action definitively. He defended the maintenance of his preliminary decision that meets part of the requests made by the government that Luiz Inácio Lula da Silva (PT).

The case was brought to trial on Friday (April 25) and would run until May 6. With the request for a view, the deadline is extended.

Read too:

LULA REQUEST

Zanin’s decision responded to a request from the AGU (Attorney General of the Union), which is also signed by Lula, filed the day before. In the request sent to the STF, the government does not indicate the number of sectors in which the exemption could be considered unconstitutional. Mention only in areas “without adequate demonstration of the financial impact”.

The government wants to end tax benefits for companies to increase revenue. The Minister of Finance, Fernando Haddad, had already signaled that he would take the issue to court.

Releasing a sector means that it will have a reduction or exemption from taxes. In practice, it makes it cheaper to hire and maintain employees in companies. Defenders of the mechanism say that this type of practice heats up the economy and promotes job creation.

The exemption for small municipalities is also included in the action sent to the Supreme Court. Currently, it is valid for those with up to 156.2 thousand inhabitants. In this case, the AGU also does not cite numbers and talks about unproductivity.

The AGU action also requests that MP (provisional measure) 1,202 of 2023 be considered constitutional. The text aimed to increase revenue through some initiatives, such as the gradual end of Perse (Emergency Program for the Resumption of the Events Sector) and tax relief.

According to the government, maintaining the mechanism goes against principles of the Federal Constitution, the Fiscal Responsibility Law (complementary law 101 of 2000) and the Budget Guidelines Law. Here is the full government request (PDF – 13 MB).

TAX IMPACT

In the government’s latest estimate, the tax exemption from the exemption would be R% 15.8 billion. As in the 1st quarter, the National Treasury already failed to collect R$4.2 billion from the modality, the potential impact from April to December 2024 is R$ 11.6 billion. Here is the full study (PDF – 705 kB).

As federal government revenue is associated with the number of company employees, the amount may be lower if there is a wave of layoffs. The request made to the STF was from the AGU (Attorney General of the Union), but led by the Minister of Finance, Fernando Haddad.

He argues that the policy created to promote jobs did not have the expected results. Furthermore, he said that, since the enactment of the Pension Reform, the tax waiver has become unconstitutional. Sectors criticize the re-encumbrance, mainly due to the sudden return that frustrates companies’ financial planning.

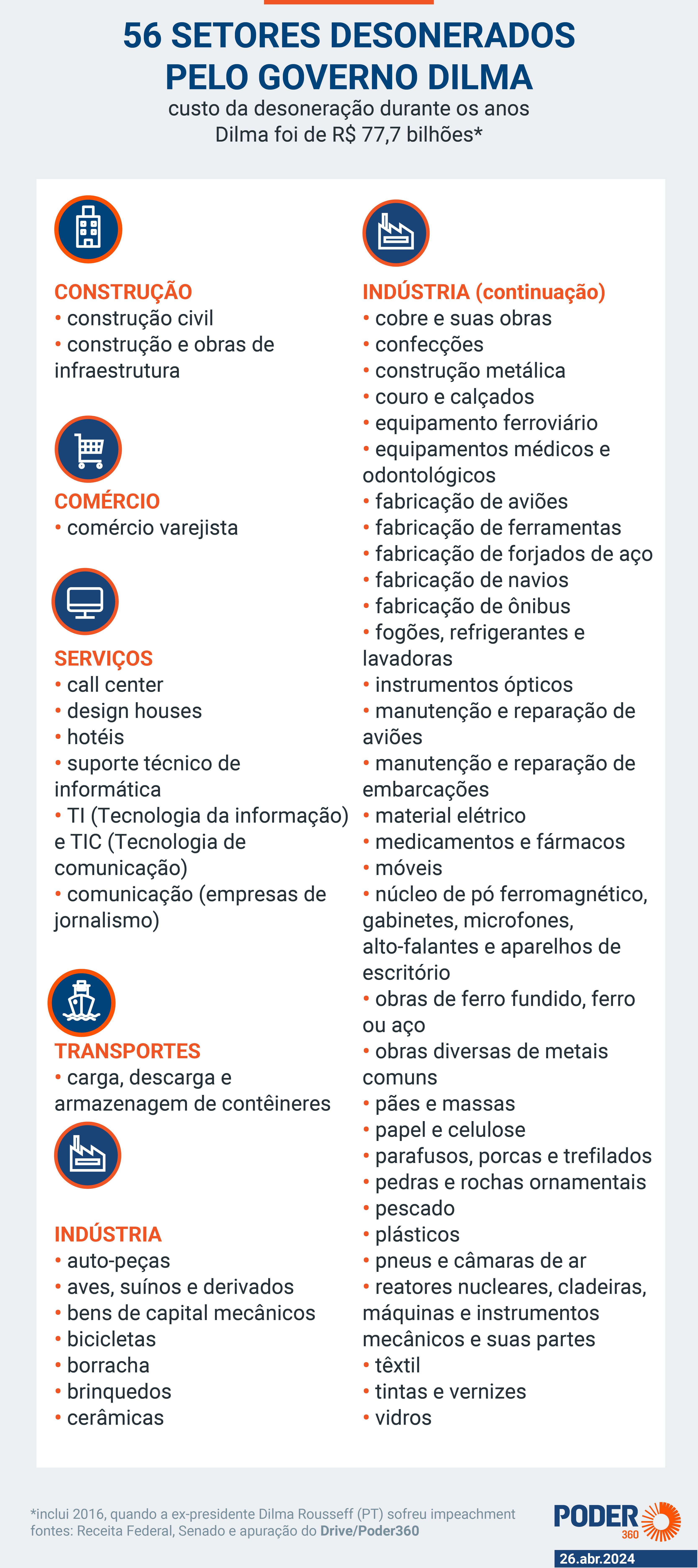

The exemption cost R$ 148.4 billion since the beginning of the policy, in 2012. Under the Dilma Rousseff (PT) government, up to 56 sectors benefited. Former president Michel Temer (MDB) reduced the number to the current 17.

COMINGS AND GOINGS

Haddad had said in December 2023 that the issue was unconstitutional and that the government would take legal action. He read the chronological order of the facts to understand the exemption impasse:

- 13.jun.2023 – Senate Economic Affairs Committee approved the extension of the benefit to 17 sectors. Haddad said “not understanding the rush” in voting on the topic;

- Oct 25, 2023 – Congress approved the postponement of the tax waiver until 2027;

- Nov 23, 2023 – Lula vetoes the measure;

- Nov 24, 2023 – Haddad says he would present a “solution” for payroll tax relief after December 12, 2023;

- 14.dec.2023 – Congress overturns Lula’s veto and exemption is maintained until 2027;

- December 28, 2023 – Haddad proposes a gradual repayment of the payroll via MP (Provisional Measure) 1,202 of 2023, with effect from April 1, 2024;

- 27.Feb.2024 – Lula removes the exemption from the provisional measure sheet and sends PL 493 of 2024 with the gradual reduction;

- 9.Feb.2024 – Chamber of Deputies approves constitutional urgency regime for re-encumbrance projects;

- April 10, 2024 – Without an agreement with Congress, the bill on reimbursement had its urgency regime withdrawn.

EXEMPTION HISTORY

More than half (52.4%) of the waiver value from 2012 to 2023 was during the Dilma government. The former president granted the benefit to 56 sectors during her term, or 39 more than currently. The Michel Temer (MDB) government reduced the number of benefited sectors from 56 to 17 since 2019. Read below what they were under Dilma’s government:

Tags: Fux requests review pauses analysis suspension payroll tax relief

--