President of the Senate will meet with legislative consultants at the official residence; meeting is scheduled for this Friday

The president of the Senate, Rodrigo Pacheco (PSD-MG), called a meeting with technicians from the Upper House to discuss the decision of minister Cristiano Zanin, of the STF (Supreme Federal Court), which blocked the payroll tax exemption.

The meeting with legislative and legal consultants is scheduled for 11:30 am this Friday (April 26, 2024), at the official residence. Pacheco must gather arguments to defend the position of the National Congress and assert that the Supreme Court’s measure is unconstitutional.

In addition to the agenda with the consultants, the senator must also call an extraordinary meeting with the Senate leaders on Monday (April 29, 2024) to address the topic.

On Thursday (April 25), Minister Cristiano Zanin, from the STF, granted the injunction that suspended the effectiveness of sections of law 14,784 of 2023. In practice, it extended the payroll tax exemption for 17 sectors of the economy until 2027. The decision followed the request of the government of Luiz Inácio Lula da Silva (PT).

Zanin’s decision was forwarded to the virtual plenary of the Supreme Court for a referendum this Friday (April 26). The trial runs until May 6. If confirmed by the other ministers, the measure will be valid until the STF judges the merits of the action.

With the Supreme Court blocked, Pacheco published a note criticizing the federal government’s decision to “judicialize” the debate surrounding payroll tax relief for companies and city halls. In the text, the senator said he respected the minister’s monocratic decision, but also stated that he would find legal ways to question the measure and present the National Congress’ arguments to the STF.

“I will also take care of political measures that ensure that Parliament’s option for maintaining jobs and survival of small and medium-sized municipalities is respected. Tomorrow, first thing in the morning, I will meet with the Senate’s consultancy and legal team to discuss the issue. A meeting of Senate leaders will also be called extraordinarily,” said in a note.

LEAF EXEMPTION

In October 2024, the National Congress approved the project that extends the payroll tax exemption policy for another 4 years. The measure, in force since 2012, represented a loss of revenue of R$139 billion for the Union until 2023, according to data from the Federal Revenue.

The Minister of Finance, Fernando Haddad, wanted to end the benefit through a provisional measure. After the negative reaction from congressmen and entities, the government took the issue to the Legislature in search of a partial victory – which did not result in the exemption.

Read which sectors benefited from Congress’s 2027 payroll tax relief:

COMINGS AND GOINGS

The Minister of Finance, Fernando Haddad, had said in December 2023 that the issue was unconstitutional and that the government would take legal action. Read the chronological order of the facts to understand the exemption impasse:

- 13.jun.2023 – Senate Economic Affairs Committee approved the extension of the benefit to 17 sectors. Haddad said “not understanding the rush” in voting on the topic;

- Oct 25, 2024 – Congress approved the postponement of the tax waiver until 2027;

- Nov 23, 2023 – Lula vetoes the measure;

- Nov 24, 2024 – Haddad says he would present a “solution” for payroll tax relief after December 12, 2023;

- 14.dec.2024 – Congress overturns Lula’s veto and exemption is maintained until 2027;

- 28.dec.2024 – Haddad proposes a gradual repayment of the payroll via MP (Provisional Measure) 1,202 of 2023, with effect from April 1, 2024;

- 27.Feb.2024 – Lula removes the exemption from the provisional measure sheet and sends PL 493 of 2024 with the gradual reduction;

- 9.Feb.2024 – Chamber of Deputies approves constitutional urgency regime for re-encumbrance projects;

- April 10, 2024 – Without an agreement with Congress, the bill on reimbursement had its urgency regime withdrawn.

TAX IMPACT

Tax relief for sectors of the economy was created during the Dilma Rousseff (PT) government. Cost R$ 148.4 billion in nominal values to public coffers from 2012 to 2023. The Luiz Inácio Lula da Silva (PT) government estimates a tax waiver of R$ 12.3 billion in 2024. In the 1st quarter of this year, the Union stopped collecting R$4.2 billion.

According to the Ministry of Finance, the biggest impact is on the land transport sector. The waiver would be R$5 billion in 2024, or 40.8% of the total.

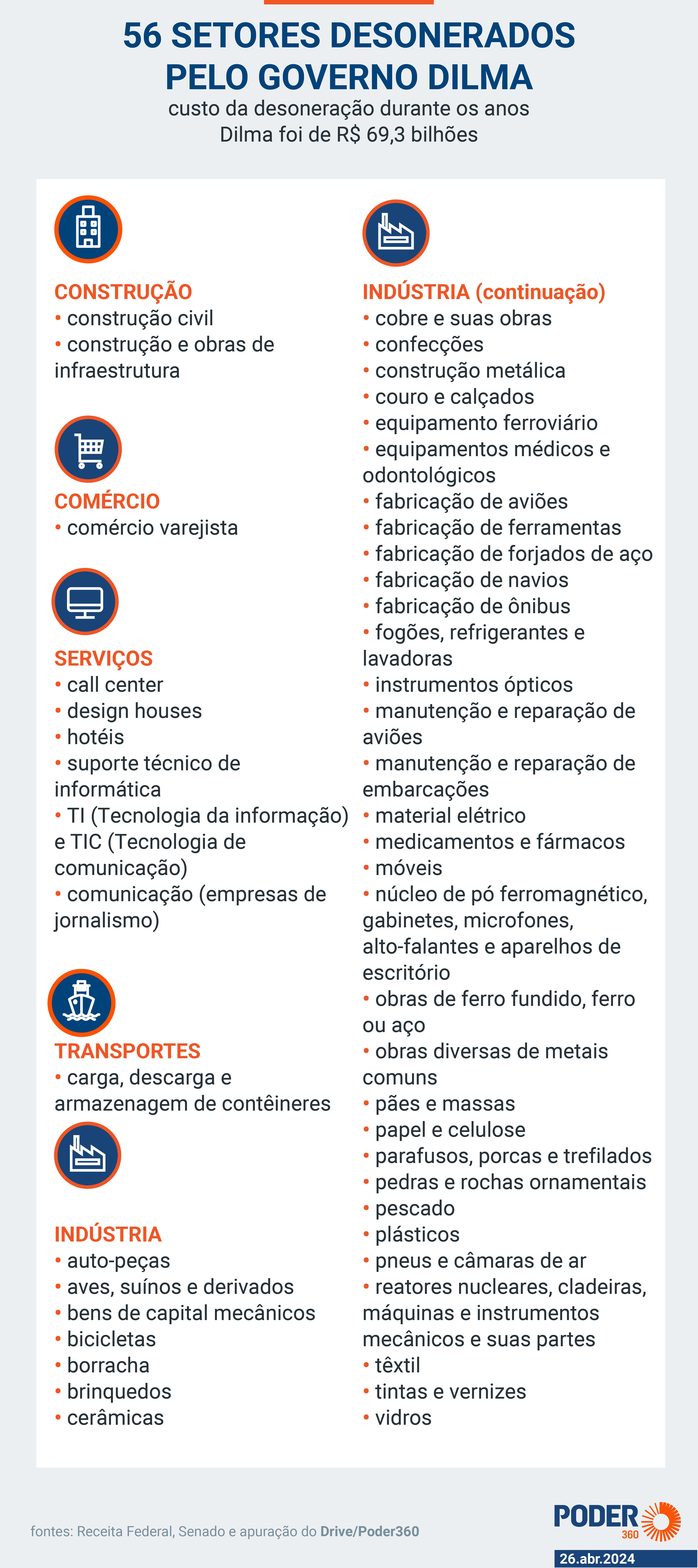

More than half (52.4%) of the waiver value from 2012 to 2023 was during the Dilma government. The former president granted the benefit to 56 sectors during her term, or 39 more than currently. Read what they were below:

Tags: Zanin suspends exemption Pacheco summons Senate technicians

--