President of the Senate says that the Executive cannot attribute a fiscal problem to the exemption

The president of the Senate, Rodrigo Pacheco (PSD-MG), stated this Friday (April 26, 2024) that he will appeal the decision of minister Cristiano Zanin, of the STF, who granted an injunction to suspend the payroll tax exemption for municipalities and 17 sectors of the economy by 2027.

The decision was taken after the senator met this Friday morning with legal advisors from the Upper House, at the official residence of the Senate Presidency. According to Pacheco, the Senate’s board of directors will present a regulatory appeal against Zanin’s decision. The appeal should be made official later this afternoon.

Zanin’s decision is in response to a request from the AGU (Attorney General of the Union), which argues that the payroll tax relief for municipalities and 17 sectors of the economy does not present the fiscal impact of the measures in their projects. “We will demonstrate in all materiality that this is a mistake”said Pacheco.

Watch (25min35s):

According to Pacheco, the federal government was only able to increase its spending thanks to the fiscal space gained by Congress. He said that the Chamber and the Senate have worked since the transition of Jair Bolsonaro’s administration to guarantee the financial sustainability of the new presidency.

The statement echoed the perception of the rest of the senators that Zanin’s decision was “disrespectful and intrusive“.

Therefore, he assesses that the decision to withdraw aid to municipalities and 17 sectors – under the argument of the unpredictable fiscal impact – is unjustified. “In the first 3 months of 2024, Brazil raised R$80 billion more than in the 3 months of 2023, and this is thanks to the work of the two houses of the National Congress where the government does not have a majority”he stated.

Among the measures approved to increase tax collection and economic growth, the Minas Gerais native cited the approval of the taxation of offshore companies, exclusive funds and sports betting, the change in the subsidy regime in addition to the tax reform and the fiscal framework. “Municipalities are not the cause of Brazil’s fiscal problem. They are the weakest link in a federal issue”he said.

“Therefore, this is definitely not true in the context in which the revenue provided by the National Congress measures went far beyond the budgetary and financial impact of these two measures [de desoneração]”, he declared.

The president of Congress stated that he will not wait for the plenary decision of the Federal Supreme Court because Zanin’s measure was monocratic – and came into force as soon as it was issued. So there is no time to waste.

The premises that supported Zanin’s decision are wrong, according to the senator. He says that the projects approved by Congress already included a forecast of the financial and budgetary impact of the measures, meeting the constitutional requirement.

“I affirm, as president of the Senate, that this premise is not true. The law that was approved provides in a very clear, categorical and material way for the required budgetary and financial estimate. Both for the exemption of the 17 sectors and for the exemption of the municipalities”, he declared.

Leaders meeting

According to Pacheco, the leaders of the party benches should meet next week to deliberate on what the Senate’s response will be to the Judiciary’s decision in conjunction with the Executive.

There is still no set date for the meeting. It must take place virtually, as congressmen will, for the most part, be in their electoral strongholds thanks to the May 1st holiday, on Wednesday.

He states that the decision “was a hasty, out of context and out of moment action”. Therefore, the agenda for the next meetings should be spending cuts and fiscal austerity.

“Since there is a provocation about this, we are going to start a big debate, with public spending cuts. Whether from a political point of view, where Congress only helped the government, or from a technical point of view, we are very convinced of the good work done”, he declared.

Pacheco also demanded that the Government be more coherent in its collection and public expenditure agenda. “There is therefore a need to have a broad discussion now about public spending and spending cuts by the federal government. What is the government’s proposal? In addition to collecting revenue, what is the government’s proposal to balance the accounts?”, he asked.

TAX IMPACT

In the 1st quarter, the National Treasury failed to collect R$4.2 billion from the modality. Therefore, the potential impact is R$ 11.6 billion from April to December 2024.

As federal government revenue is associated with the number of company employees, the amount may be lower if there is a wave of layoffs. The request made to the STF was from the AGU (Attorney General of the Union), but led by the Minister of Finance, Fernando Haddad.

He argues that the policy created to promote jobs did not have the expected results. Furthermore, he said that, since the enactment of the Pension Reform, the tax waiver has become unconstitutional. Sectors criticize the re-encumbrance, mainly due to the sudden return that frustrates companies’ financial planning.

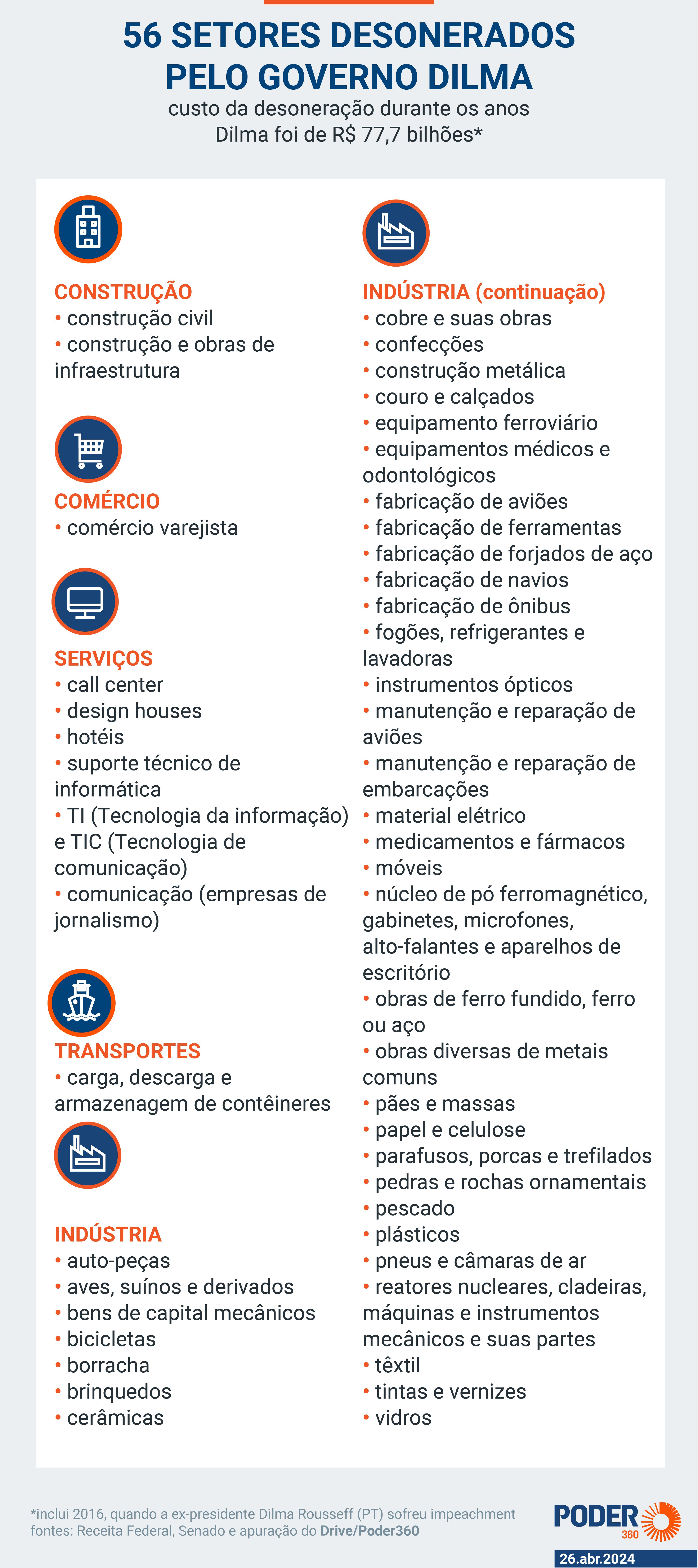

The exemption cost R$ 148.4 billion since the beginning of the policy, in 2012. Under the Dilma Rousseff (PT) government, up to 56 sectors benefited. Former president Michel Temer (MDB) reduced the number to the current 17.

COMINGS AND GOINGS

Haddad had said in December 2023 that the issue was unconstitutional and that the government would take legal action. He read the chronological order of the facts to understand the exemption impasse:

- 13.jun.2023 – Senate Economic Affairs Committee approved the extension of the benefit to 17 sectors. Haddad said “not understanding the rush” in voting on the topic;

- Oct 25, 2023 – Congress approved the postponement of the tax waiver until 2027;

- Nov 23, 2023 – Lula vetoes the measure;

- Nov 24, 2023 – Haddad says he would present a “solution” for payroll tax relief after December 12, 2023;

- 14.dec.2023 – Congress overturns Lula’s veto and exemption is maintained until 2027;

- December 28, 2023 – Haddad proposes a gradual repayment of the payroll via MP (Provisional Measure) 1,202 of 2023, with effect from April 1, 2024;

- 27.Feb.2024 – Lula removes the exemption from the provisional measure sheet and sends PL 493 of 2024 with the gradual reduction;

- 9.Feb.2024 – Chamber of Deputies approves constitutional urgency regime for re-encumbrance projects;

- April 10, 2024 – Without an agreement with Congress, the bill on reimbursement had its urgency regime withdrawn.

EXEMPTION HISTORY

More than half (52.4%) of the waiver value from 2012 to 2023 was during the Dilma government. The former president granted the benefit to 56 sectors during her term, or 39 more than currently. The Michel Temer (MDB) government reduced the number of benefited sectors from 56 to 17 since 2019. Read below what they were under Dilma’s government:

CORRECTION

April 26, 2024 (2:05 p.m.) – Unlike what was published in this post, some dates of the “comings and goings” of the exemption were in 2023 and 2024, and not just in 2024. The text has been corrected and updated.