Investing.com – After much noise and turmoil surrounding this topic, analysts and investors celebrate the announcement of the distribution of extraordinary dividends from Petrobras in the amount of R$21.9 billion, around R$1.76 per share, corresponding to 50% of company’s capital reserve, but they are already eyeing the other half. The expectation, with the repercussion, is that the remaining amounts could be announced in the second half of this year.

At 11:03 am (Brasília time), preferred shares (BVMF:) rose 0.68%, to R$41.39. ADRs (NYSE:) gained 1.42% to US$16.88.

Are you thinking about investing in oil companies? View EPS history, peer comparisons, fair-price models, dividend yield charts and other data on InvestingPro! Prices up to 40% OFF TODAY only, and get EXTRA discount with the coupon INVEST.

Since Petrobras had announced dividends in March, but without the amounts of additional earnings, the shares suffered from repercussions, and had been improving with the change in analysts’ perception following media reports that indicated a consensus from the government, the company’s largest shareholder, regarding this topic. The issue also involved the intensification of tensions between the company’s president, Jean Paul Prates, who had previously suggested paying this half, and the Minister of Mines and Energy, Alexandre Silveira, as well as other members of the government, who disagreed with the payment and if articulated for retention. However, according to Silveira, the Petrobras Board needed to consider “the needs of the Treasury”. The federal government should receive around R$6 billion in extraordinary dividends from Petrobras, amid difficulties in closing public accounts.

Third-party advertising. It is not an offer or recommendation from Investing.com. Read our guidelines here or

remove ads

.

Bank of America (NYSE:) (BofA) considered the announcement as “a move in the right direction”, and which helps to calm investors regarding concerns related to a growth agenda for Petrobras, which would lead to greater investments, mergers and acquisitions, possibly at the expense of higher dividends.

With the distribution, BofA estimates a dividend yield of 16% for this year for Petrobras, which would be higher than the peer average of around 8.7%. The bank also considers it important to mention that the news indicates that the government does not rule out paying the remaining amount in the capital remuneration reserve in the second half of the year, that is, another R$22 billion. “A decision on this is expected in the coming months”, highlights BofA, which has a neutral indication and a target price of US$16.80 for ADRs.

Source: InvestingPro

According to Itaú BBA, the announcement confirms the green light previously indicated by the Board, which had understood that the payment of 50% of capital reserves as extraordinary dividends would not compromise the financial sustainability of the state-owned company.

“Furthermore, the possibility of the company paying the remaining 50% of capital reserves as extraordinary dividends this year is a positive option that should increase the appeal of holding the shares”, points out Itaú BBA in a report released to clients and the market, which indicates a market performance recommendation for the company’s shares, with a target price of R$43 for preferred shares and US$16.7 for ADRs.

EQI Investimentos, which considers the state-owned company to be “the big star” of its dividend portfolio, believes that “there will be no difficulty for the company to distribute the remaining 50% by the end of the year, given the strong quarterly results throughout 2024 that will occur.”

Third-party advertising. It is not an offer or recommendation from Investing.com. Read our guidelines here or

remove ads

.

Meanwhile, Genial Investimentos considers that the total distribution “is technically justified in view of the current price level of oil, low level of extraction and debt under control”.

Source: InvestingPro

What InvestingPro says about Petrobras

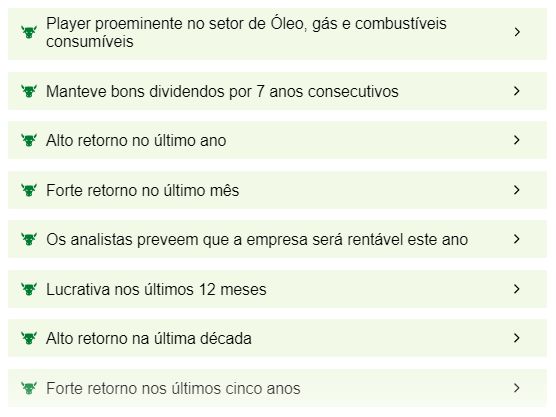

Petrobras pays good dividends to shareholders and the shares have had a high return over the last year, according to InvestingPro. Protips, artificial intelligence (AI) insights based on fundamental indicators, also indicate that the company has had a strong return over the last five years.

Source: InvestingPro

Petrobras’ financial health is considered to have excellent performance, with a score of four, on a metric that ranges from one to five.

Source: InvestingPro

The fair price for preferred shares in Brazil is estimated at R$60.19, an expected upside of 45%, according to 14 investment models compiled by InvestingPro. The analyst target is more pessimistic, at R$42.13.

Source: InvestingPro

For ADRs listed on the American market, the target price is US$

Do you want to invest in oil companies like Petrobras, but are you looking for more data about them? To have access to the financial models referring to the fair price indicated in the InvestingProhistorical financial statements, dividend return, price-to-earnings ratio and comparison with peers of all Brazilian companies, in addition to more than 135,000 shares from around the world, access the platform!

Outperform the market with the best insights with up to 40% off at InvestingPro! For an EXTRA discount, use the coupon INVEST for Pro and Pro+ annual and 2-year subscriptions

See how to apply the coupon in the video below

Third-party advertising. It is not an offer or recommendation from Investing.com. Read our guidelines here or

remove ads

.

Tags: Analysts celebrate extra dividend eyeing Investing .com

--